Income-focused funds that invest in bonds and other short-term securities often make these distributions on a monthly basis whereas stock. Ad Get results for All about mutual funds on Life123 for Indonesia.

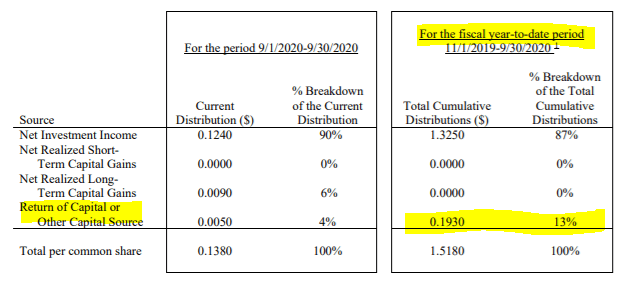

Closed End Fund Distribution Tax Character Mistakes And Misunderstandings Seeking Alpha

Why do mutual funds make distributions.

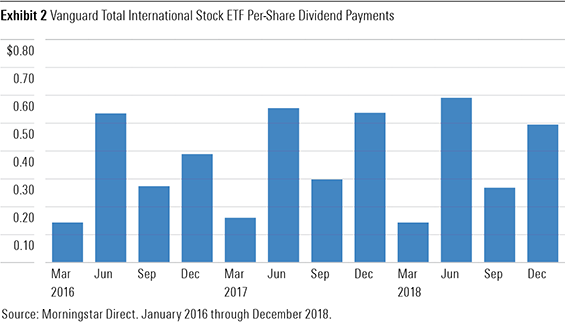

How often do mutual funds pay distributions?. What is a distribution. These distributions are the result of management selling shares of one or more of the funds holdings during the taxable year. With stock funds payouts can occur once twice or four times a year.

Capital Gains if required for Fidelitys equity and bond funds are generally paid after each funds fiscal year end andor at calendar year end. How often are distributions made. The frequency varies by the specific fund distributions can be paid monthly quarterly or annually.

12112020 If you receive a distribution from a fund that results from the sale of a security the fund held for only six months that distribution is taxed at your ordinary-income tax rate. Mutual fund distributions can take one of three forms. 11142018 The frequency with which mutual funds pay capital gains varies.

Mutual funds generate returns in a variety of ways including the distribution of dividends. Include fees paid for marketing and selling fund shares such as compensating brokers and others who sell fund shares and paying for advertising the printing and mailing of prospectuses to new investors and the printing and. 352020 Mutual funds collect this income and then distribute it to shareholders on a pro-rata basis.

Depending on the type of fund dividend payments can be paid monthly quarterly semi-annually or annually and the tax consequences of dividend distributions depend on the type of account that holds your mutual funds. Find What You Are Looking For. Since ROC represents a return to the investor of a portion of their own invested capital payments received are not immediately taxed as income.

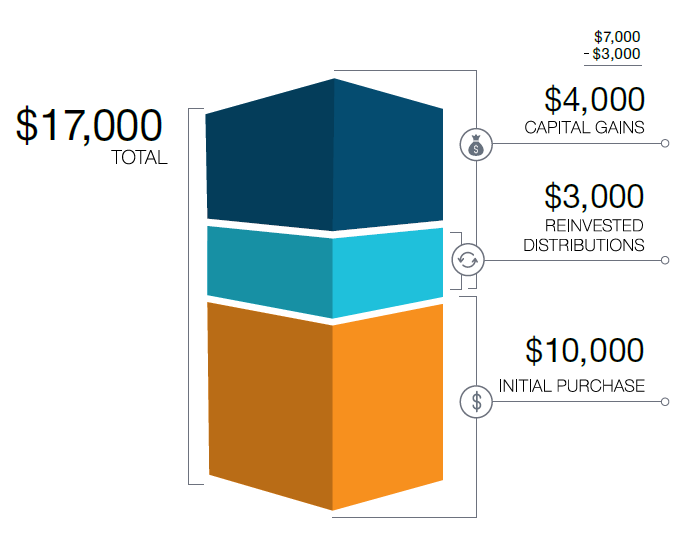

Money Market and Bond Funds. 11252020 Mutual fund distributions are derived from net capital and can affect your tax cost. What Is a Capital Gains Distribution.

All funds are legally required to distribute their accumulated dividends at least once a year. When the funds are earning this income and holding it before the distribution it is reflected in the funds net asset value NAV. With bond funds this income is typically passed along to investors once a month.

Ad Get results for All about mutual funds on Life123 for Indonesia. The estimates are as of the date shown in the last column of the table. The actual distributions will be paid on the Pay Date shown in the table.

Mutual funds pass on these dividends because quite simply theyre required to in order to avoid taxation. The rule permits a fund to pay distribution fees out of fund assets only if the fund has adopted a plan 12b-1 plan authorizing their payment. Tax laws require mutual fund companies to distribute net.

7272020 Mutual funds are required to distribute net capital gains and accrued income to shareholders at least annually. Certain mutual fund distributions can receive more favorable tax treatment than others. A mutual fund distribution represents the earnings of a fund being passed on to the individual investor or unitholder of the fund.

Most mutual fund companies pay distributions once or twice a year. Because you are paid every three months divide each quarterly payment into thirds and use only that portion of your bond fund income each month. ROC often occurs when a funds objective is to pay a fixed monthly distribution to unitholders.

4192017 Mutual funds typically pass distributions on to shareholders to avoid taxation which shifts the tax burden to shareholders for their portion of profits. Find What You Are Looking For. However funds that generate a profit within a given year are required to distribute gains to.

When funds pay distributions their NAV adjusts accordingly a share price falls 5 after a 5 per share distribution and individual investors are taxed on the distribution amount. Mutual fund shareholders face the possibility of receiving capital gains distributions from their mutual funds each year around November or December. The mutual fund rules require net capital gains to be distributed once a year and almost all mutual funds stick with an annual distribution at the end of the year.

Youre responsible for reporting mutual fund distributions on your tax return. Although they buy and sell securities throughout the year and stockspay dividends at different times during the year the cost ofbookkeeping and mailing statements to shareholders limits thefrequency of distributions.

Understanding Capital Gains And Taxes On Mutual Funds T Rowe Price

What Is Distribution Definition Types More

The Future Of Fund Distribution Accenture

Understanding Distribution Of Income By Unit Trust Funds

Unraveling Foreign Dividends Morningstar

Covid 19 Impact On Dividend Income Learning To Live With Dividend Cuts The Financial Express

The Future Of Fund Distribution Accenture

Unraveling Foreign Dividends Morningstar

:max_bytes(150000):strip_icc()/dotdash_Final_Forward_Dividend_Yield_2020-01-167ed1a41c1c48599fa394f4f4faf342.jpg)

Forward Dividend Yield Definition

The Future Of Fund Distribution Accenture

3 Stocks Paying Special Dividends During The 2nd Quarter

Etfs Vs Mutual Funds Why Investors Who Hate Fees Should Love Etfs Kiplinger

Maximize Aftertax Returns With Etfs Morningstar

Beware Direct Mutual Fund Plans Are Great But They Have A Dark Side Too

The Future Of Fund Distribution Accenture

The Future Of Fund Distribution Accenture

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

Unraveling Foreign Dividends Morningstar

As Dividends Get Cut Etf Offers Steady 7 Annual Distribution Rate